Big cheques for NT gas aids

Four NT public servants are being paid up to $390,000 a year to help the gas industry.

Four NT public servants are being paid up to $390,000 a year to help the gas industry.

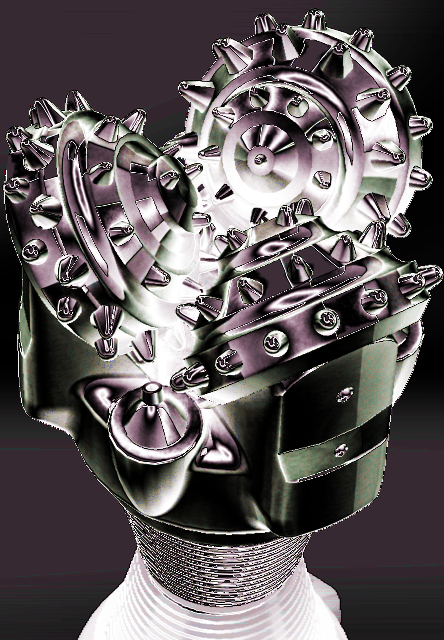

In the year since the NT lifted its ban on fracking, at least four Northern Territory public service executives have been appointed to manage and implement gas industry regulation.

The known positions include executive director of onshore gas reform, onshore gas developments, hydraulic fracturing inquiry implementation and a senior director of petroleum operations.

Each director is paid an annual salary of between $217,533 and $391,848.

When the fracking ban was lifted - opening one of the biggest untapped natural gas resources in Australia – the government said engineering works would begin “within days”.

Zero wells have been drilled since the ban was lifted, while three solar farms are currently under construction.

This is despite the government not setting up any similar executive positions with “solar” or “renewable energy” in the title.

The NT Chief Minister's spokesperson says it is acceptable to focus government money on helping the gas industry but not the renewables industry because the gas industry offers a more immediate investment opportunity.

“At present, there are multiple gas companies who are on track to begin exploration of onshore gas this dry season,” the spokesperson said.

“We would welcome investment from the hydrogen industry and there is interest both domestically and overseas in the Territory's hydrogen, though this is in its early stages.

“Territory Labor also has a renewables policy of 50 per cent by 2030 — and hydrogen has a role to play in this.”

One company, Origin Energy (which has an exploration project in the NT’s Beetaloo Basin) says there is a long way between exploration and production.

There are also questions over whether NT gas will be the economic saviour that the Government hopes it will be.

A report commissioned by the South Australian Government has found that NT gas will be some of the most expensive in Australia, with production costs estimated at $AU7.50/GJ.

“This estimate will also likely prove to be optimistic,” another report from the Institute of Energy Economics and Financial Analysis stated.

“Even taking the cost of production at face value at $AU7.50/GJ, the costs of production do not compare favourably on a global scale.”

Some US gas averaged $AU3.55/GJ in March 2017, while in Qatar gas production costs came in below $AU0.20/GJ.

Print

Print